A global inventory of oil refineries reveals an expansion of high emission new facilities in Asia and the Middle East.

The oil refining industry contributes to 4% of global emissions, and an audit of its status is overdue. In 2021, an international team published a thorough review called the Carbon Emission Accounts and Datasets-Global Refinery Emission Inventory (CEADs-GREI).

The researchers, led by the distinguished Professor of Climate Change Economics at Tsinghua, Dabo Guan, and PhD candidate Tianyang Lei, based CEADs-GREI on 1,056 refineries in operation between 2000 and 2018. In a paper published in August 2021, they revealed a continued growth in oil refinery emissions in the last two decades, as well as a trend since the 2008 financial crisis towards an increase in the number and intensity of new refineries in Asia and the Middle East.

After considering future output as well as planned additional plants, they have concluded that a 10% reduction in CO2 emissions can be achieved by 2030 via more efficient petrochemical processing integration at new facilities, upgrading catalytic cracking units at old facilities to cleaner hydrocracking units, renewable fuels, and the installation of carbon capture and storage devices.

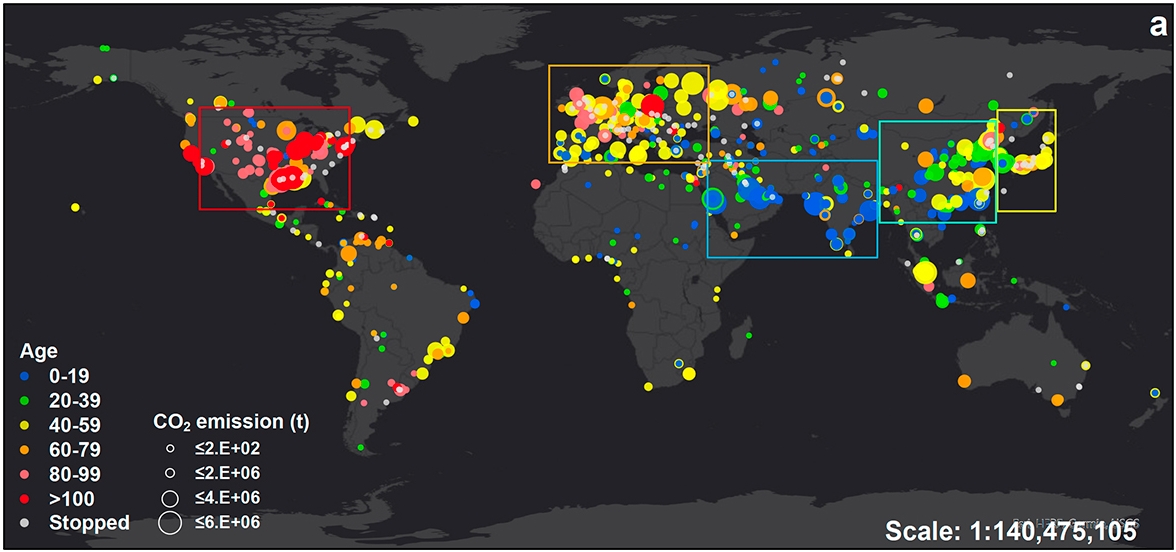

A heatmap of oil refinery age and emissions shows a clear concentration of older refineries in North America and a much younger cohort across Asia and the Middle East.

“The remaining carbon budget for 1.5°C and 2°C from the beginning of 2020 is 400 and 1,150 gigatonnes of CO2 respectively,” Guan points out. “If all the existing and proposed refineries operate as usual, without adopting any low-carbon measures, we estimated the cumulative CO2 emission of global oil refineries from 2020 to 2030 will be 16.5 Gt, accounting for 4% of the remaining 400 Gt carbon budget. Coordinated action in this space could have a huge impact.”

Oil refineries move east

In addition to mapping geographical distribution of refineries, CEADs-GREI looked closely at their age. In the developed regions of the United States, Europe, and Japan for example, older refineries (40 years or older) tend to dominate, while most facilities in the Middle East, China and India are relatively new (less than 40 years). This reflects the origins of the industry in the United States in the 1930s, followed by its spread to other regions.

The study also looked at whether plants were shallow processing refineries, meaning a simple configuration without conversion units, or more complex deep processing refineries, with catalytic cracking and hydrocracking units. Unlike shallow processing refineries, deep processing refineries can convert heavier, cruder oil into lighter products such as petrol. They tend to be much larger, and their emissions per unit of throughput are four times higher

The study found global refining and emissions generally rose steadily over the 20-year period it surveyed. The increase was reversed briefly by the 2008 financial crisis. Since then, there has been a clear shift in capacity towards Asia.

The shift towards Asia should continue over the coming years adds Guan, with 85% of new capacity built in emerging regions. CO2 emissions will thus continue to rise, from 1,242 million tonnes in 2018 to 1,343 Mt in 2025, but not only because of greater throughput. Heavier and lower quality crude oil supply and increasing demand for light refined oil products will drive a configuration shift from shallow processing refineries to deep processing ones. This was one of the study’s important findings, and it will work against emissions reduction.

The committed emissions and regional distribution of the global oil refining industry in 2018 and 2025.

Foundation for lower emission strategies

Lei is hoping the study will form a basis for global coordinated action. “Our time series, global oil refining CO2 emissions inventories at the plant-level, will provide a firm basis for the analysis of technology-driven carbon mitigation pathways worldwide,” she says.

As for how reduction can be achieved, the study indicated that the best way will be to improve the efficiency and technology of existing plants without adding new refineries and refining equipment, against the backdrop of growing demand for light refined oil products and heavier crude oil supply.

Efficiency improvements will yield the biggest gains in Asia’s newer and less well-run refineries, where, for example, the addition of petrochemical processing units for value added production could lead to greater output without the need to increase emissions hugely. “We hope to see more oil refining-petrochemical integrated facilities in the future,” says Guan. Technical improvements, including the upgrading of fluid catalytic cracking units – which convert crude oils into gasoline, olefinic gases, and other petroleum products – to cleaner hydrocracking will make the most difference in the older plants of the United States. In the long run, carbon capture and storage technology should also be added, says Guan.

CEADs-GREI will certainly inform the policy of China, which has been the world’s largest greenhouse gas emitter since 2005. Its oil refining industry, which has been the fastest growing, is currently the second largest. Two of its state-owned oil companies – China National Petroleum Corporation and China Petrochemical Corporation – control about 10% of global distillation throughput.

“In the face of these pressures, China is still the first developing country to have committed to carbon neutrality before 2060,” notes Guan. “To achieve carbon mitigation and sustainable development, more vigorous measures will be taken.”

Reference

Lei, T., Guan, D., Shan, Y., Zheng, B., Liang, X. et al Adaptive CO2 emissions mitigation strategies of global oil refineries in all age groups One Earth 4(8), 1114-1126 (2021)

doi: https://doi.org/10.1016/j.oneear.2021.07.009